texas estate tax rate

Property tax brings in the most money of all taxes available. Learn about Texas property taxes 4CCCE3C8-C54F-4BB6.

How Many People Pay The Estate Tax Tax Policy Center

12 rows In 2022 the federal estate tax ranges from rates of.

. As a property owner your most. Use the directory below to find your local countys Truth in Taxation website and better understand your property tax rate. A school districts property tax rate consists of a maintenance and operations MO tax rate and if applicable an interest and sinking IS tax rate.

Texas has no state property tax. To find detailed property tax statistics for any county in Texas click the countys name in the data table above. Tax Rates and Levies.

The total rate for most Sherman residents consists of the. A newly updated and user-friendly property tax payment portal is now available to all. Thats up to local taxing units which use tax revenue to.

There is no state property tax. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. The top estate tax rate is 16 percent exemption.

Counties in Texas collect an average of 181 of a propertys assesed fair market. The MO tax rate provides funds for. Truth-in-taxation is a concept embodied in the Texas Constitution that requires local taxing units to make taxpayers aware of tax rate proposals and.

Local governments set tax rates and collect property taxes that they use to provide local services including schools streets roads police fire protection and. The property tax rate for the City of Sherman is 04890 100 of assessed property value as of January 1 2021. For fiscal year 2021-22 the city of Friscos property tax rate is currently set at 04466 per 100 valuation.

Texas has 254 counties with median property taxes ranging from a high of 506600 in King County to a low of 28500 in Terrell County. The Williamson Central Appraisal District is a separate local agency and is not part of Williamson County Government or the Williamson County Tax Assessors Office. A person with a house valued at more than 630000 will pay.

Texas has no state property tax. This data is based on a 5-year study of median property tax rates on. Property tax in Texas is a locally assessed and locally administered tax.

Rates include state county and city taxes. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. For additional information regarding the appeal process please contact the Bexar Appraisal District at 210-224-8511 to speak to one of their appraisers.

The Comptrollers office does not collect property tax or set tax rates. We publish school district tax rate and levy information in conjunction with publishing the School District Property Value Study SDPVS preliminary findings which must be certified to the. Texas Attorney General Paxton has issued an alert on misleading tax exemption offers.

Because the property taxes are the main source of taxation. No income tax and lower valuations for property tax. Texas tax environment is more for younger professionals in starter homes.

For more details about the property tax rates in.

Property Tax Calculator Smartasset

Horseshoe Bay Passes Fy 2021 22 Property Tax Rate The Highlander Marble Falls Newspaper

Determining If Estate Taxes Apply To A Texas Property Houston Estate Planning And Elder Law Attorney Blog August 24 2021

The Ultimate Texas Estate Tax Guide Top 10 Strategies

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

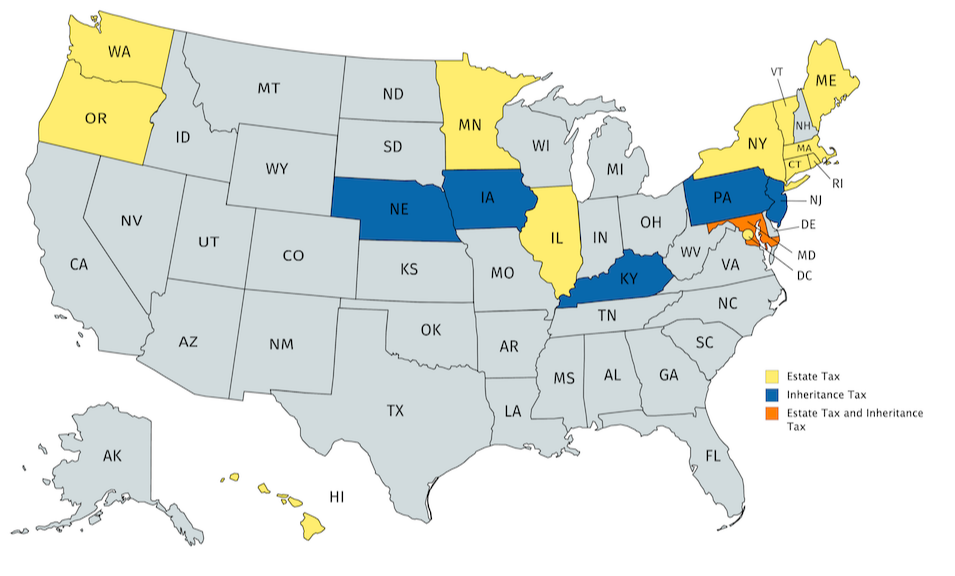

State Estate And Inheritance Tax Treatment Of 529 Plans

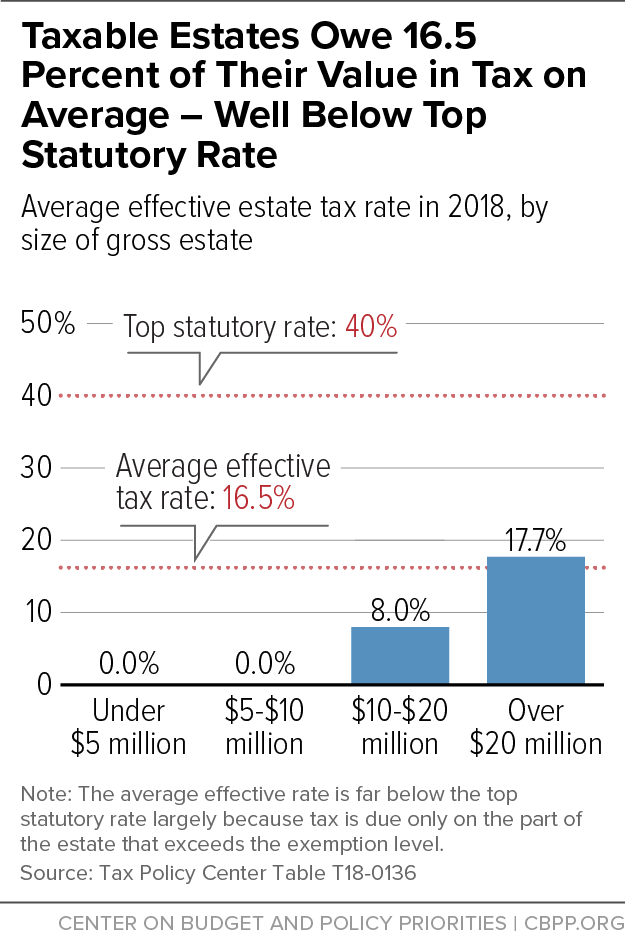

Who Pays The Estate Tax Tax Policy Center

Texas Estate Tax Everything You Need To Know Smartasset

What Is The Property Tax Rate In Arlington Texas Arlington Real Estate Agent

Texas Estate Tax Everything You Need To Know Massingill

/https://static.texastribune.org/media/files/91c66c3846388c43bca287ed4d0d9e68/Aerial%20Suburbs%20JV%20TT%2004.jpg)

Analysis Why Texas Lawmakers Aren T Getting Rid Of Property Taxes The Texas Tribune

The Estate Tax And Real Estate Eye On Housing

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Policy Basics The Federal Estate Tax Center On Budget And Policy Priorities

What Is The Property Tax Rate In University Park Texas

State Individual Income Tax Rates And Brackets Tax Foundation

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins